The claim falls outside the scope of the insurance policy—like a procedure not included in your health plan or damage not covered by your homeowner’s policy.

Errors on the claim form—wrong codes, missing documents, improper modifiers and pointers—can trigger an automatic denial.

Filing a claim after the deadline can lead to an outright denial. Timeliness is key.

Especially in some types of health insurance, payer may not oblige to certain procedures for various reasons. Understanding and fulfilling is important.

If premiums haven’t been paid or the policy has lapsed, the insurer won’t honor the claim, even if it’s legitimate. Could be because of many reasons.

Improper eligibility check good lead to claim submitted to the wrong payer. Its important to check before submission, or even before the patient visit.

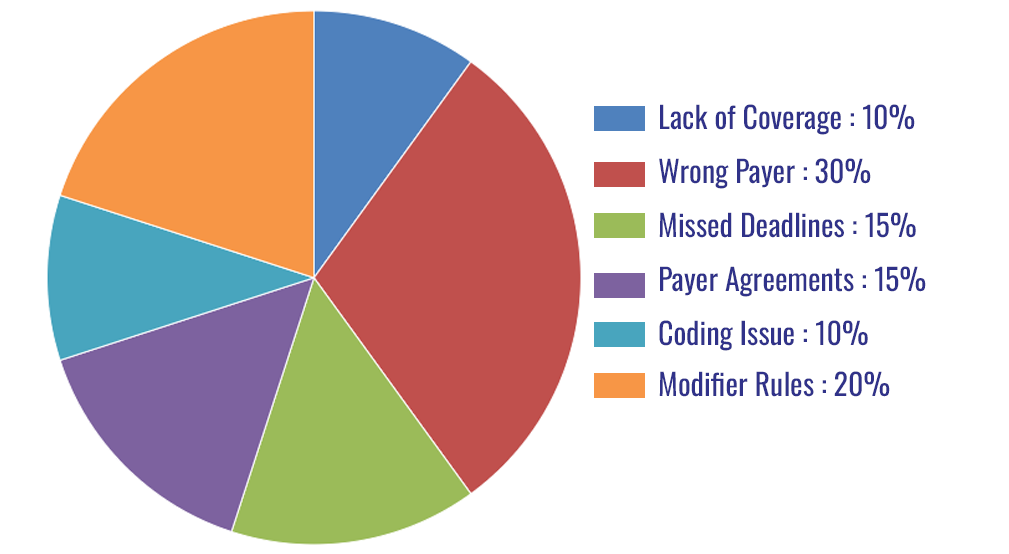

"Following diagram shows the general reasons for denials with approximate percentage of each reason."

This entire process involves following up on underpaid claims, understanding the reasons for underpayment, and then recovering revenues from the payers by taking steps to address those issues (resubmitting claims, appeals, etc.)